Twenty-five years after its construction, the Anthony High School theater boasts a new glow.

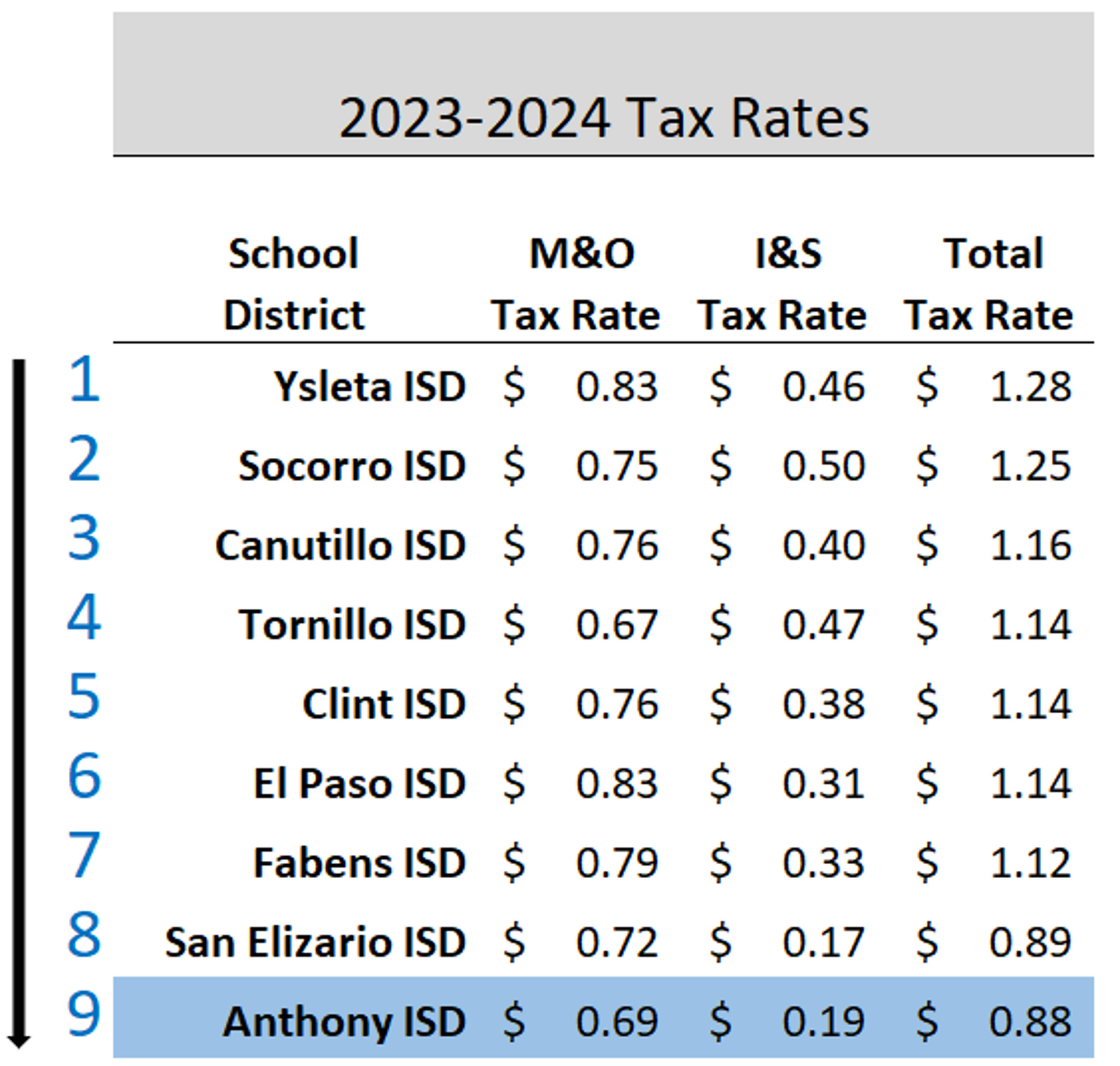

Thanks to funds obtained through the Voter-Approval Tax Rate Election (VATRE)—approved by voters in November—Anthony Independent School District purchased a sophisticated lighting system for its auditorium.

The district’s only auditorium is widely used for student fine arts performances, award presentations, elementary school graduations, and district convocations.

“The previous lighting system was installed when Anthony High School was built in 1999,” said Superintendent Dr. Oscar A. Troncoso.

“Many of the old lights no longer worked. Not only was it necessary to update an obsolete system, but we hope the features of our new system give our school community yet another reason to be proud of being at Anthony ISD.”

Click the image on the right to read more.